5 Year Advantage in Financial Services

Overview

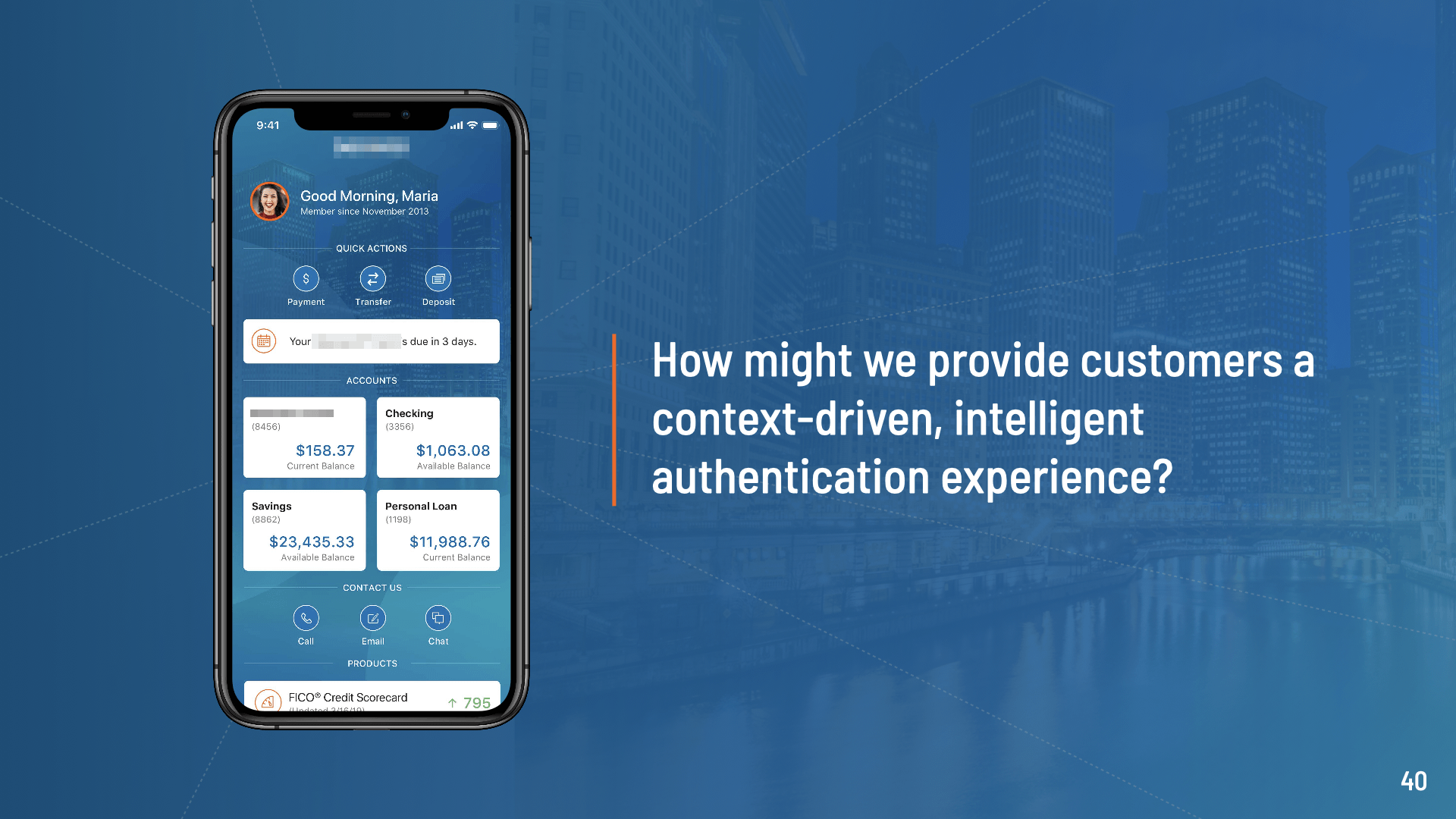

Our client, a $12 billion revenue financial service provider, faced the challenge of protecting customer accounts in a market rife with competitive disruption and security breaches. Our goal was to enhance trust and security through an improved authentication experience, with a focus on long-term customer empowerment and partnership.

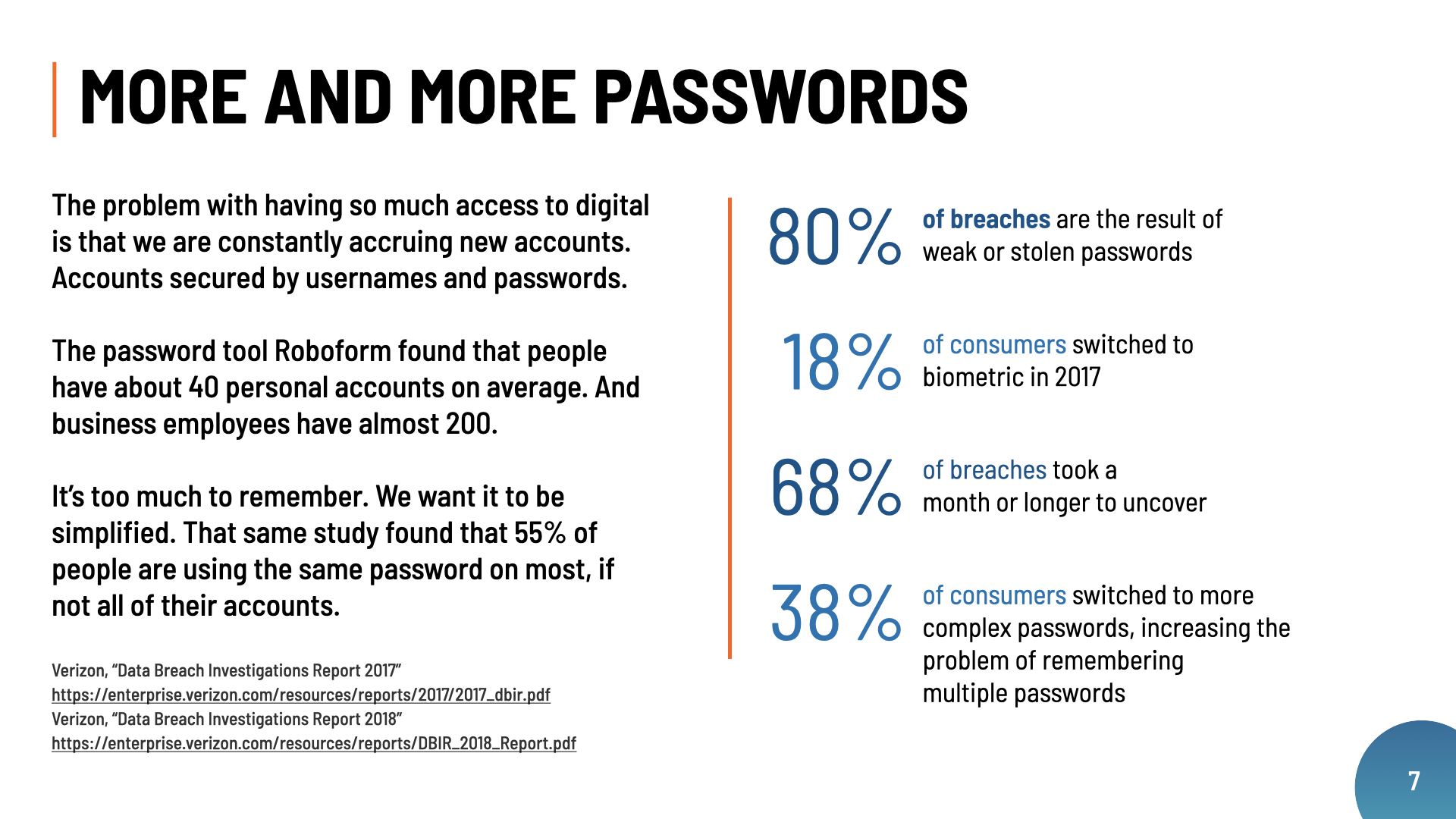

With the banking service industry's competitive landscape intensifying due to new digital-first entrants, our client recognized the need to evolve. Their commitment to financial empowerment for loyal customers was at risk as security breaches became more prevalent due to authentication vulnerabilities.

Objectives

- Enhanced Security: Explore stronger authentication methods that reduces the risk of breaches.

- Customer Trust: Design an authentication experience that bolsters customer confidence in security measures.

- Long-term Strategic Roadmap: Deliver a strategic plan for authentication interoperability across portfolio services.

Methods

- Market Research: To understand the current landscape, customer expectations, and the competitive difference required for our client.

- Prototype Testing: Validation of authentication concepts to ensure user-friendliness and security.

- Design Fiction Workshops: To imagine future scenarios and the impact of authentication solutions, preparing for long-term adaptability.

Solutions

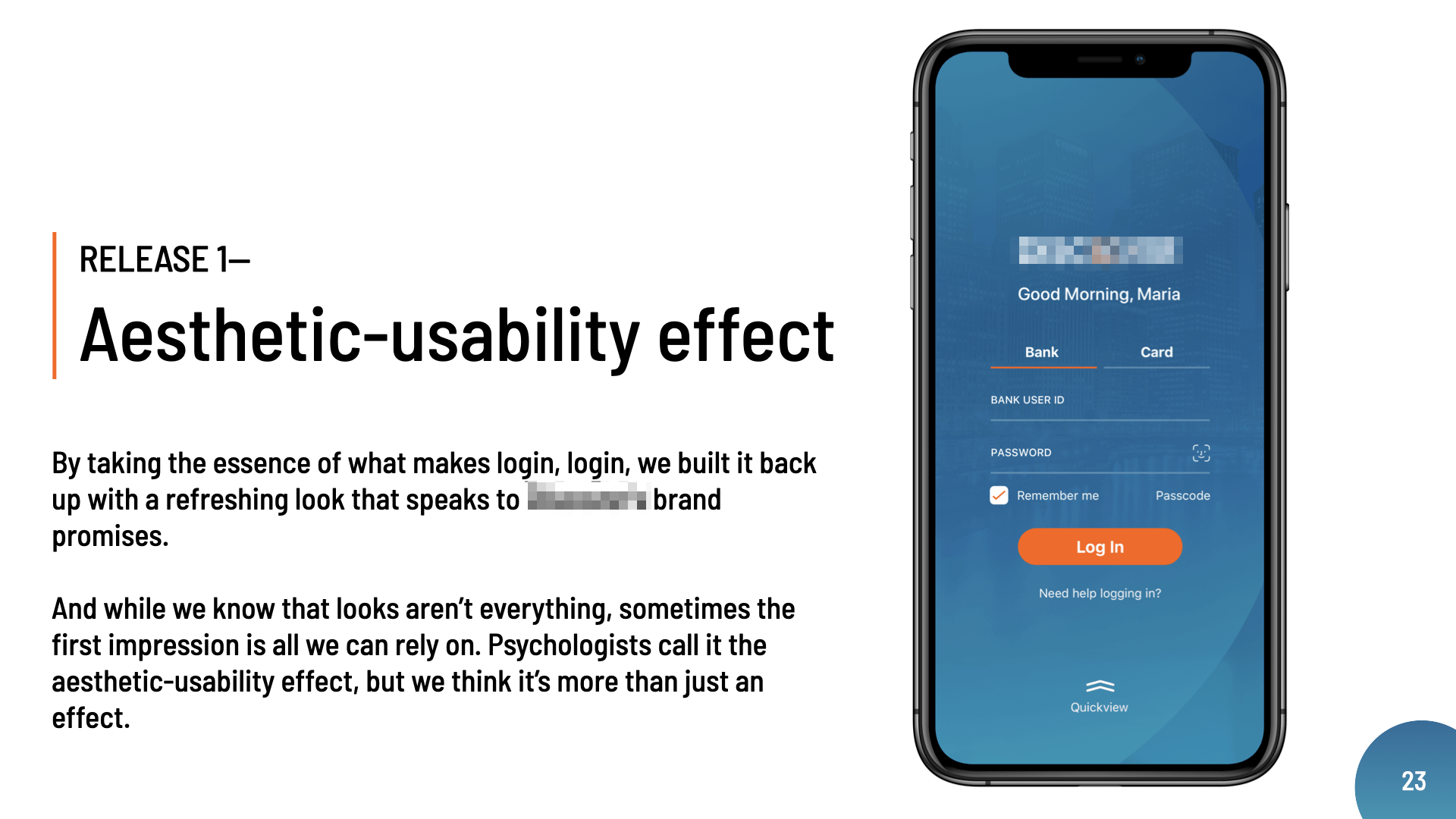

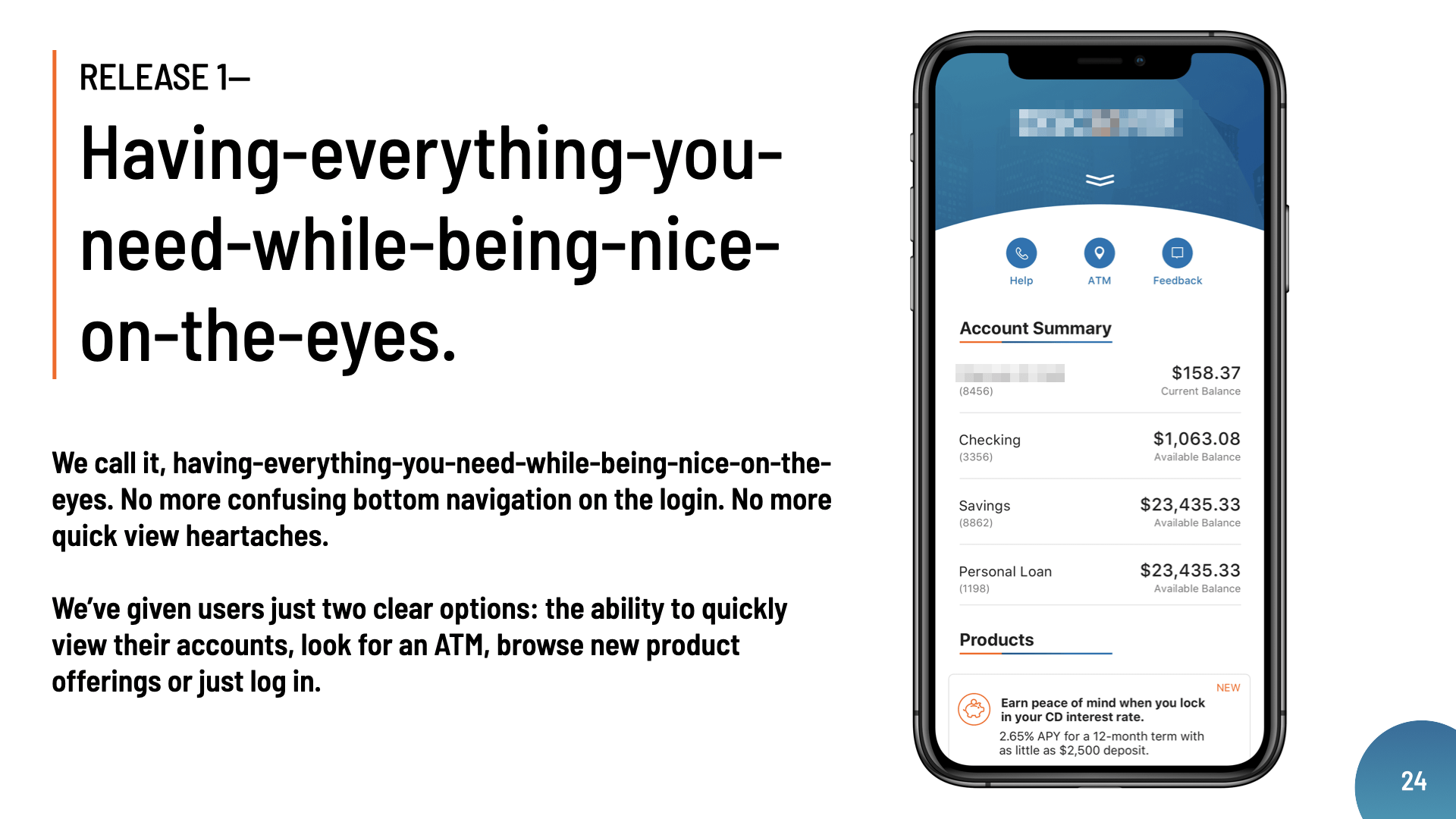

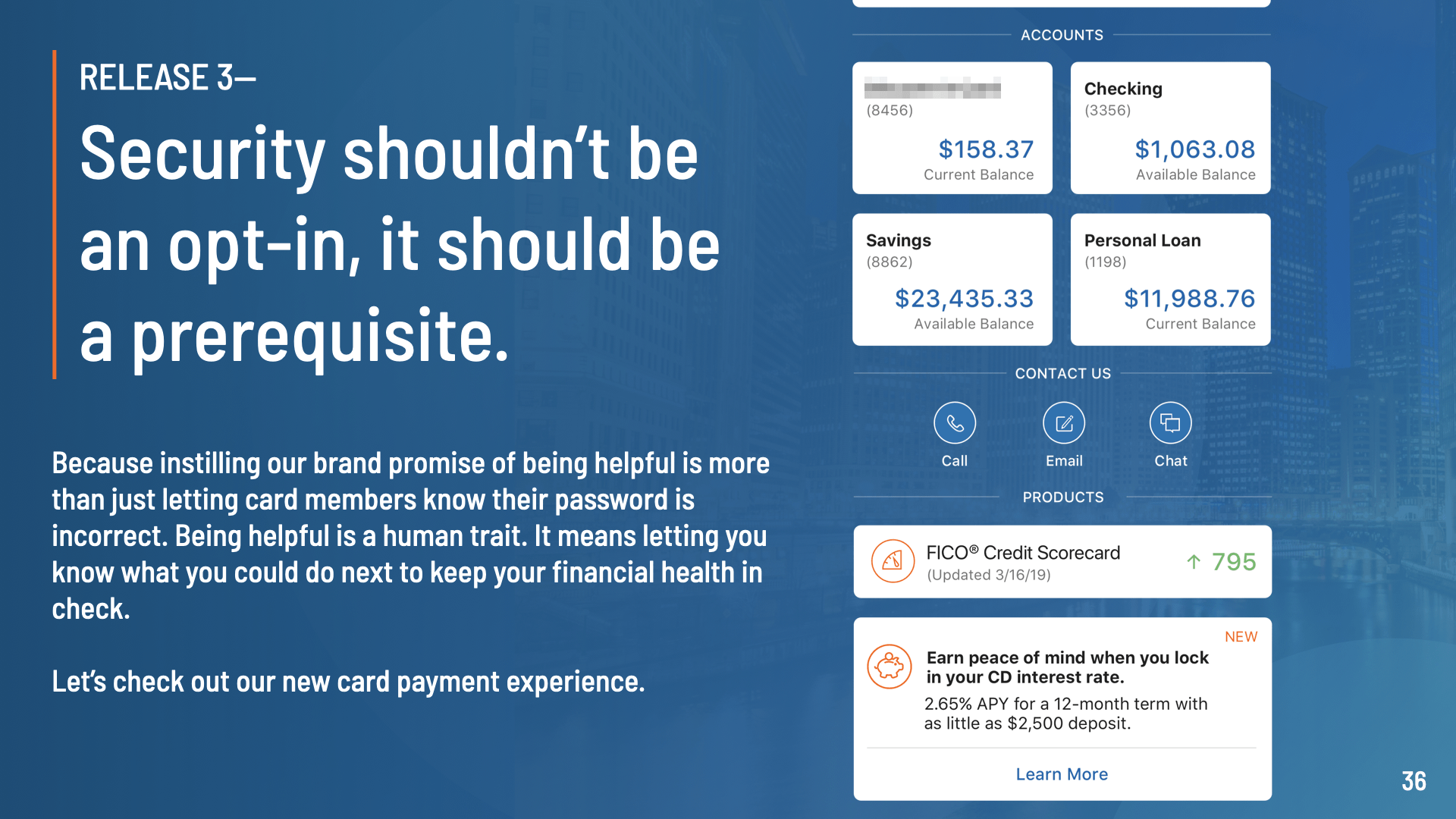

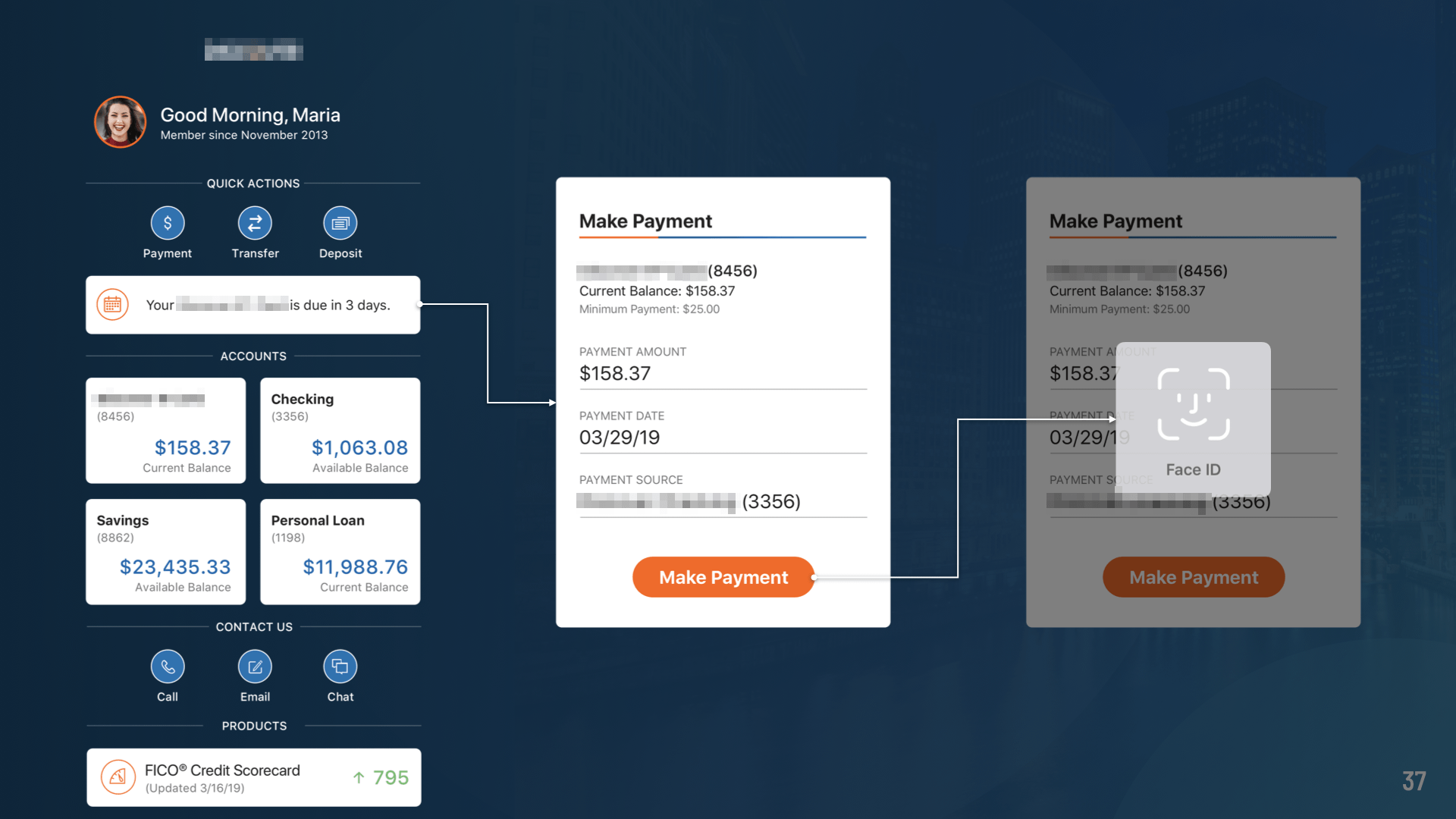

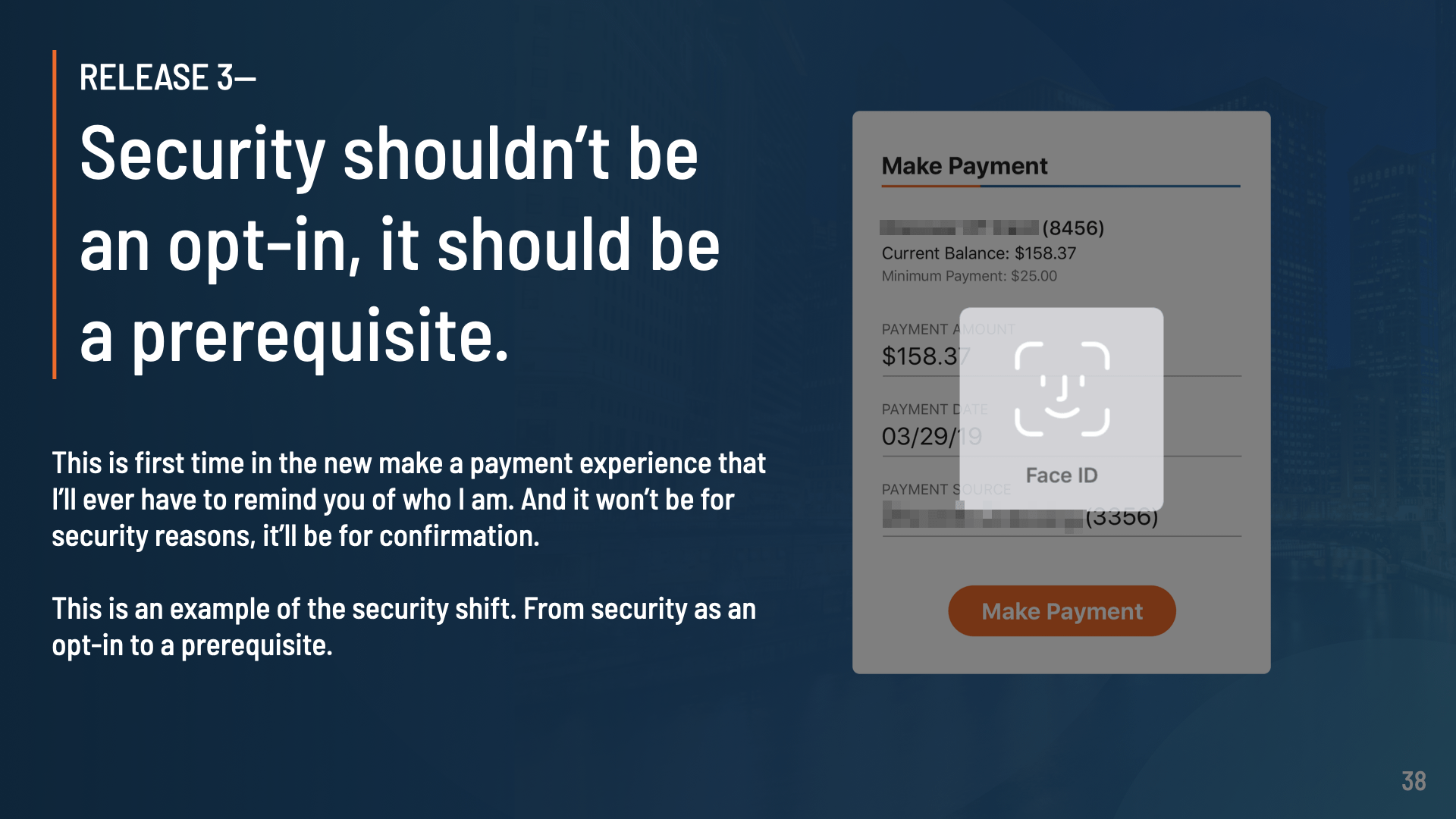

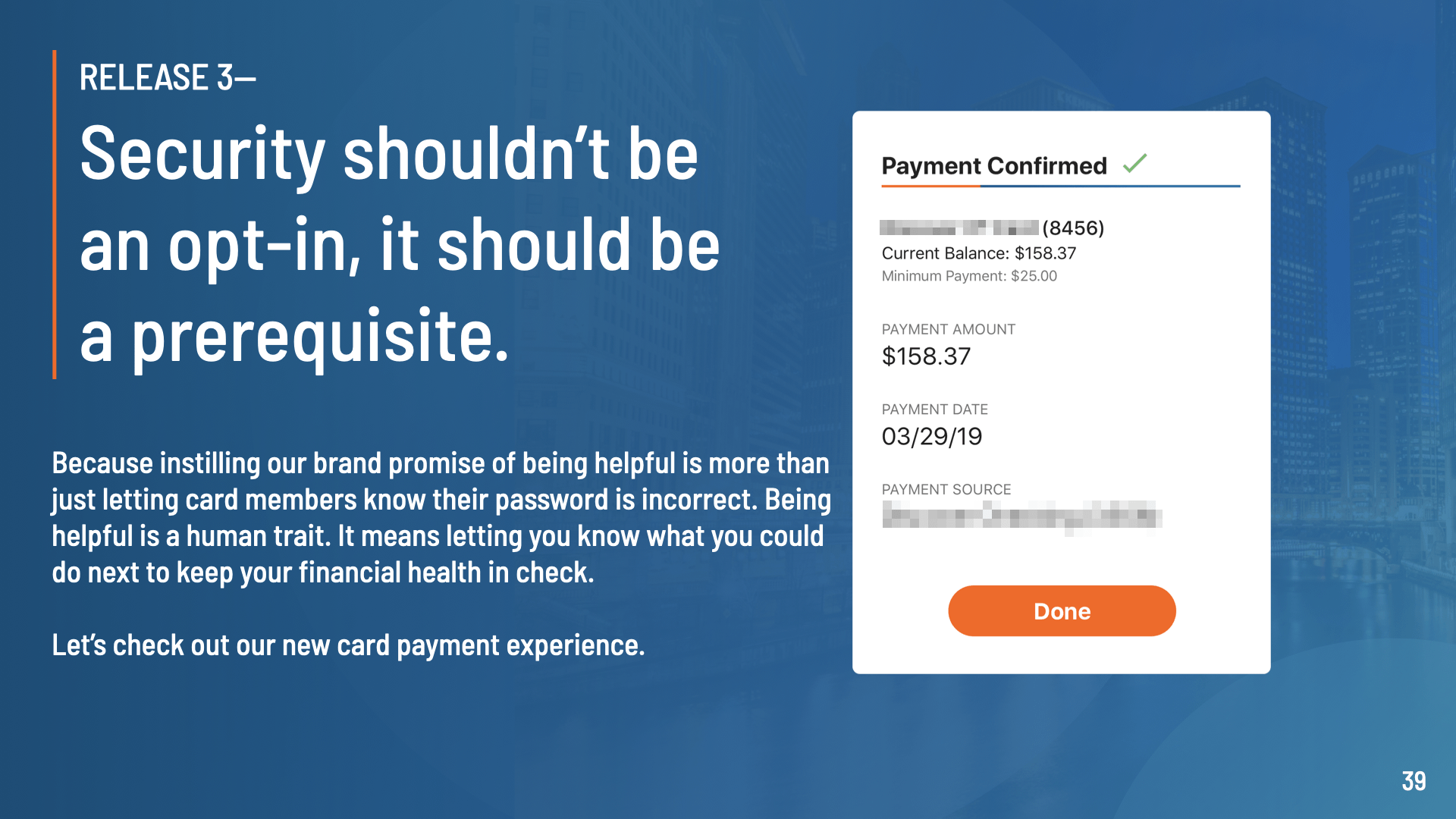

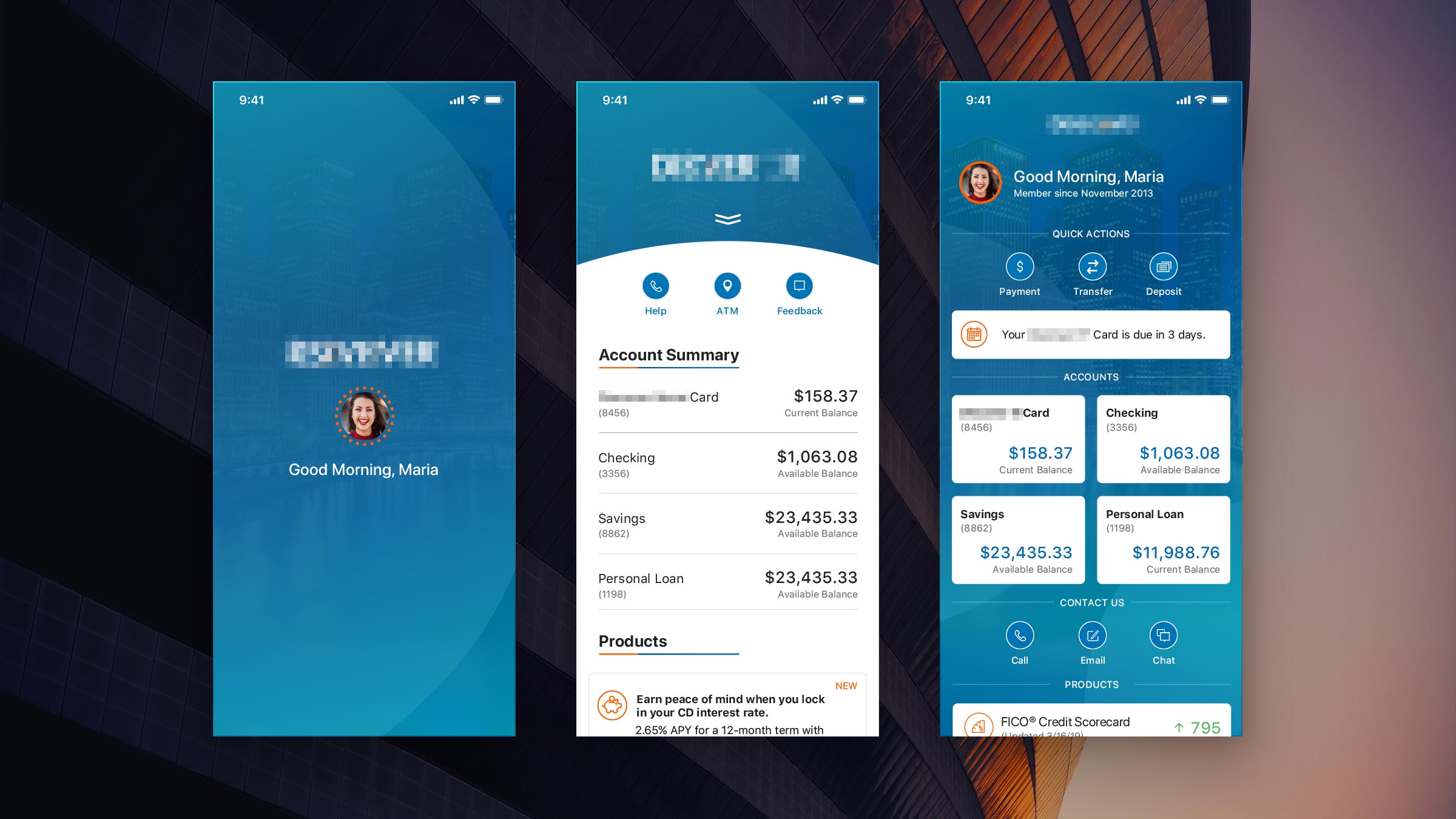

User-Centric Authentication Design

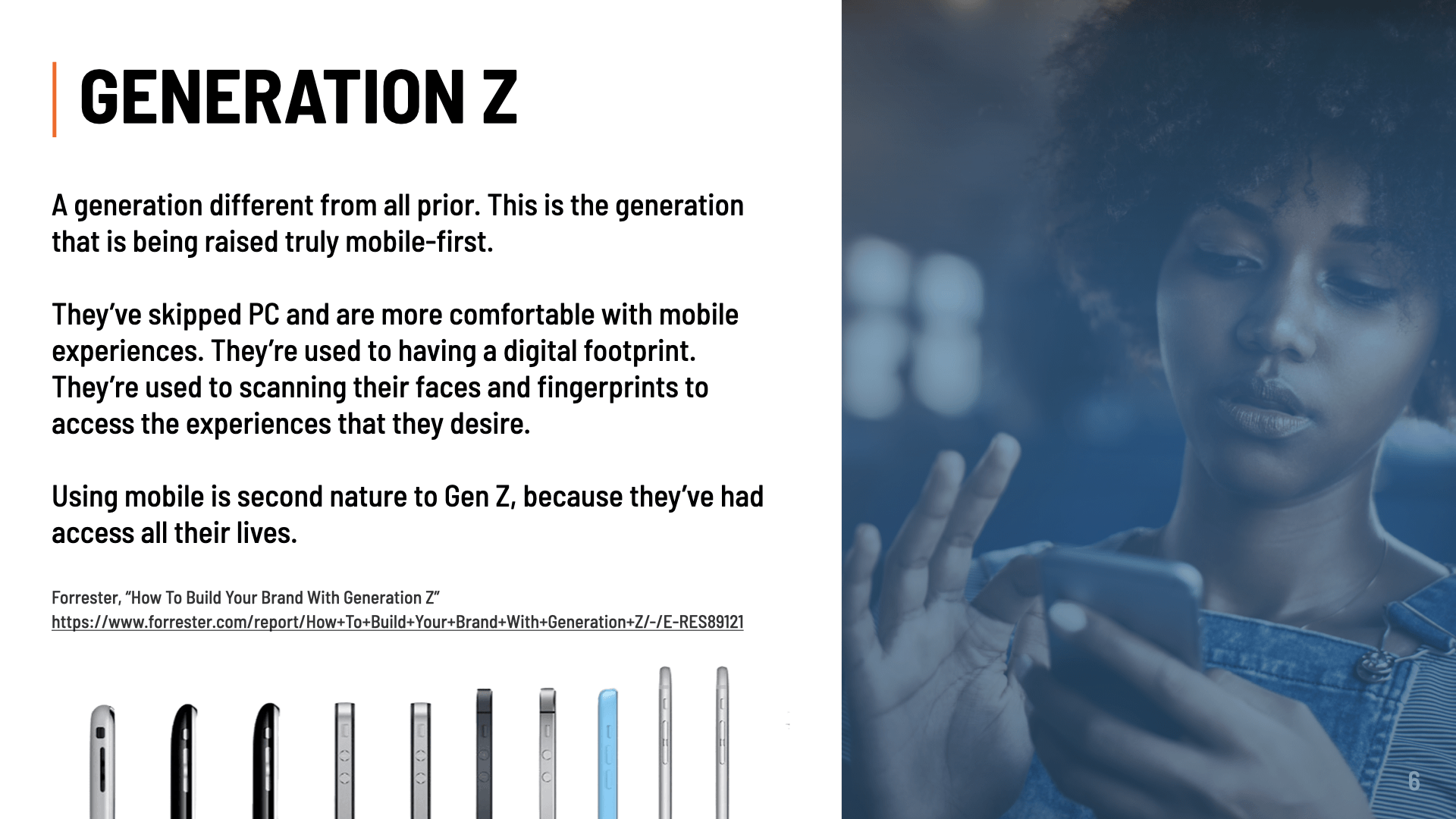

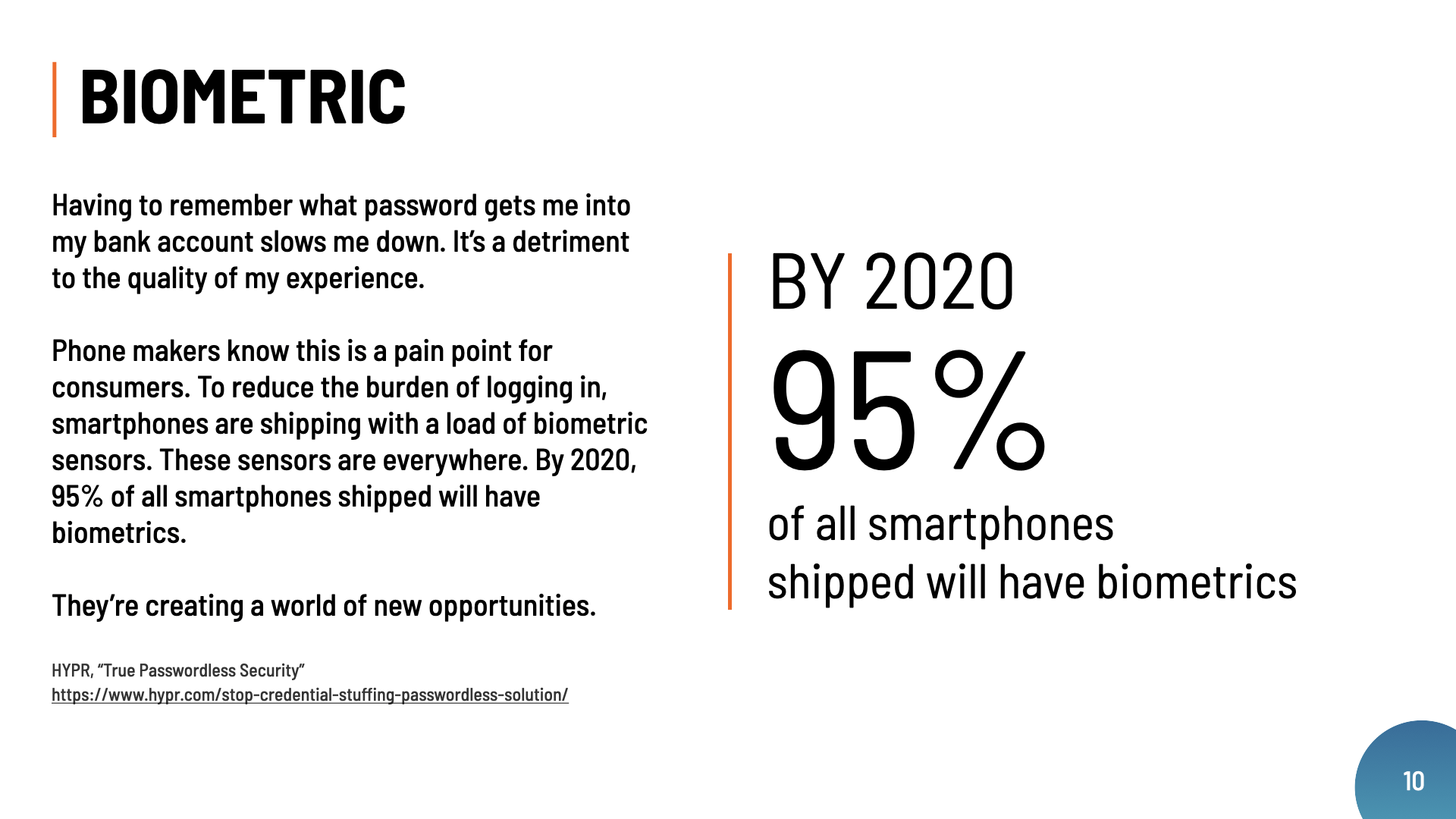

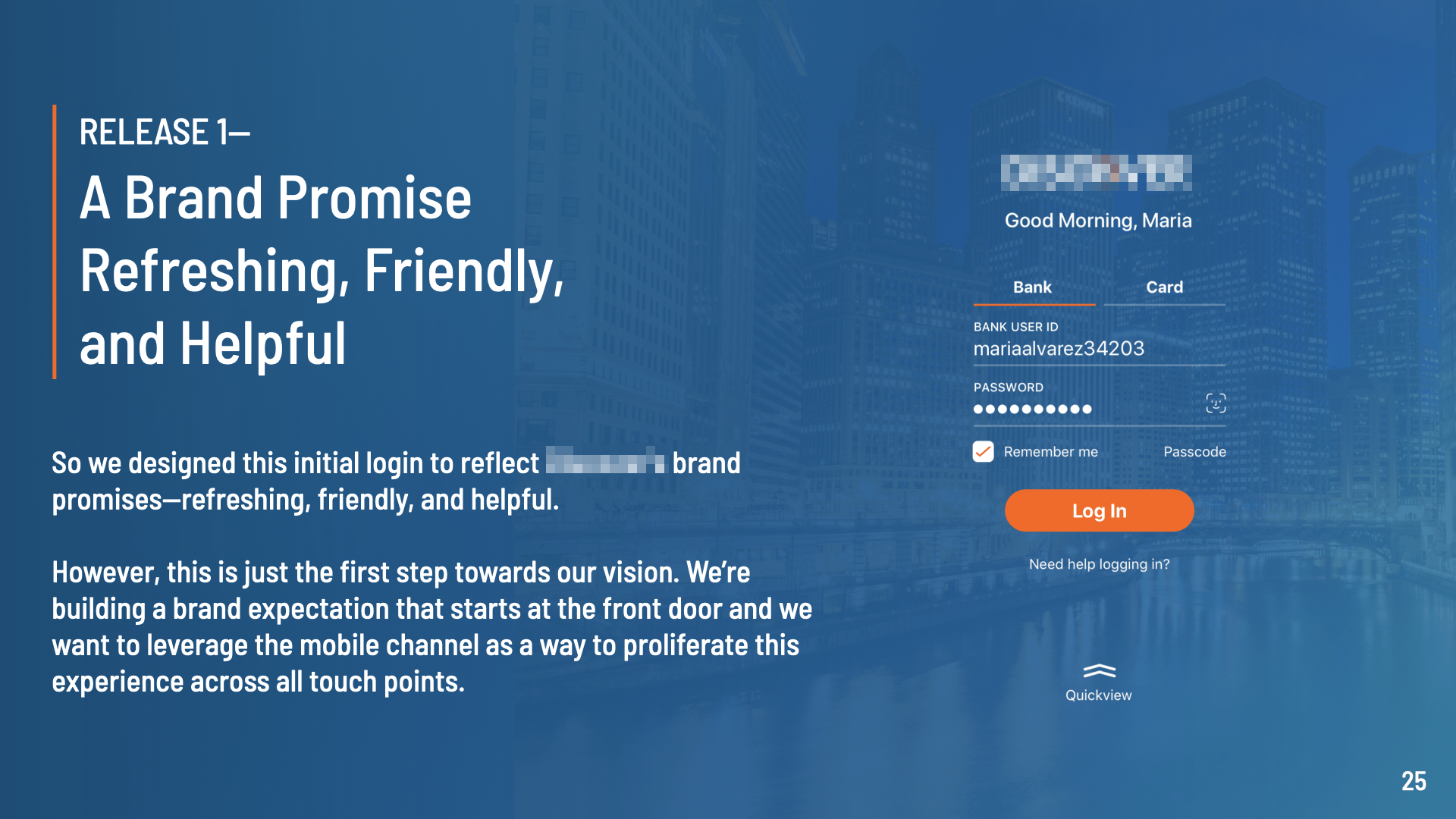

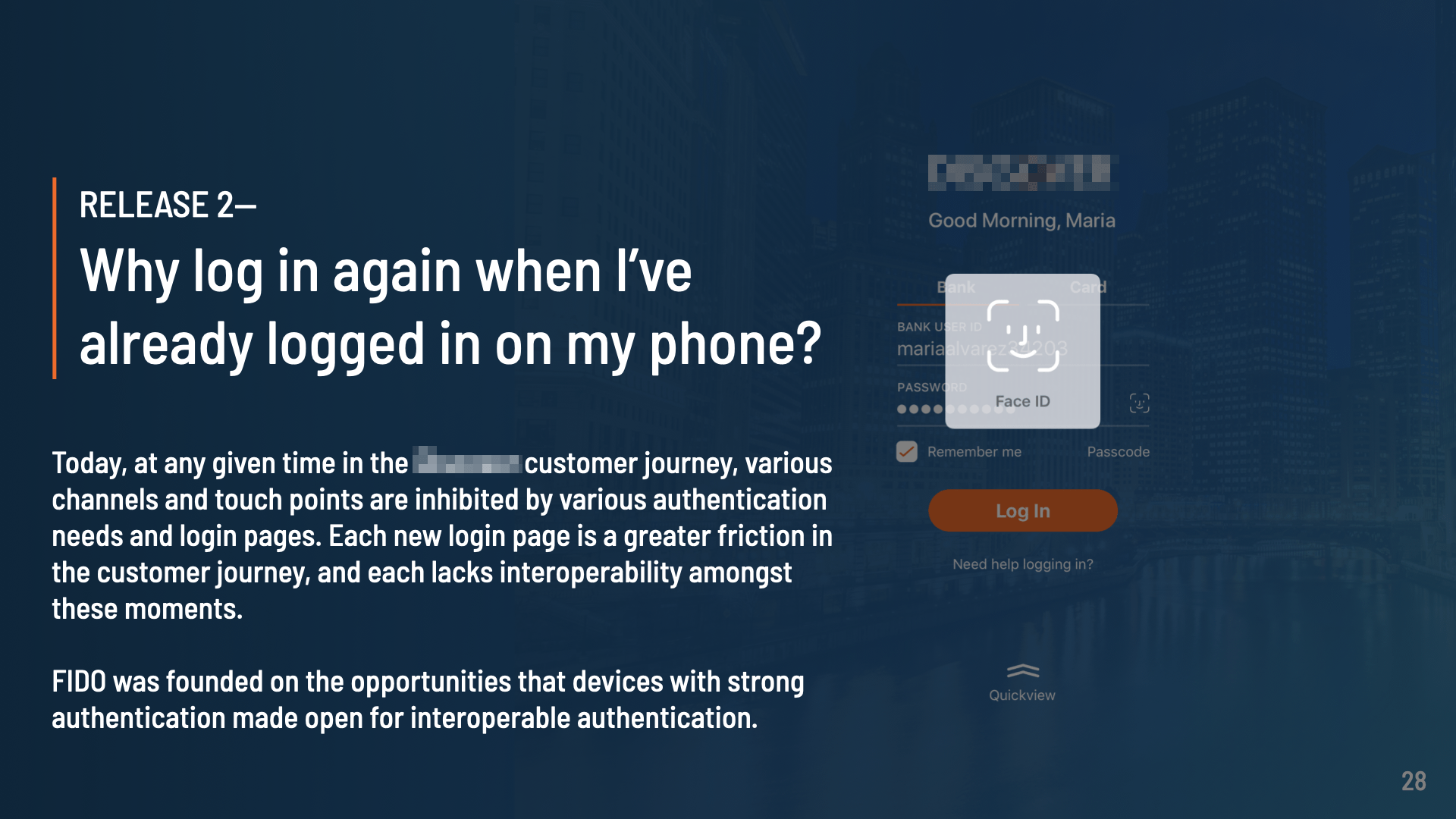

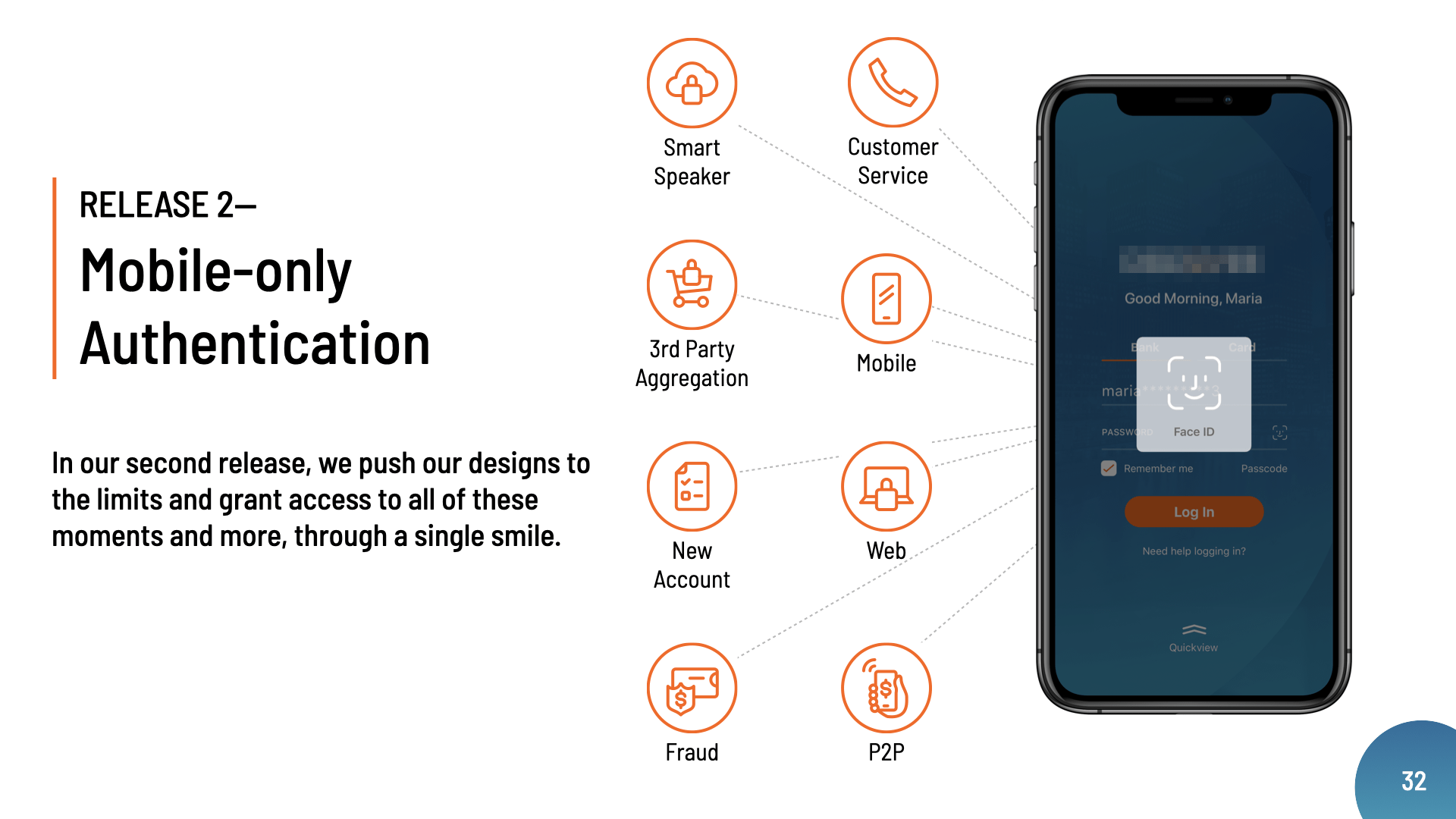

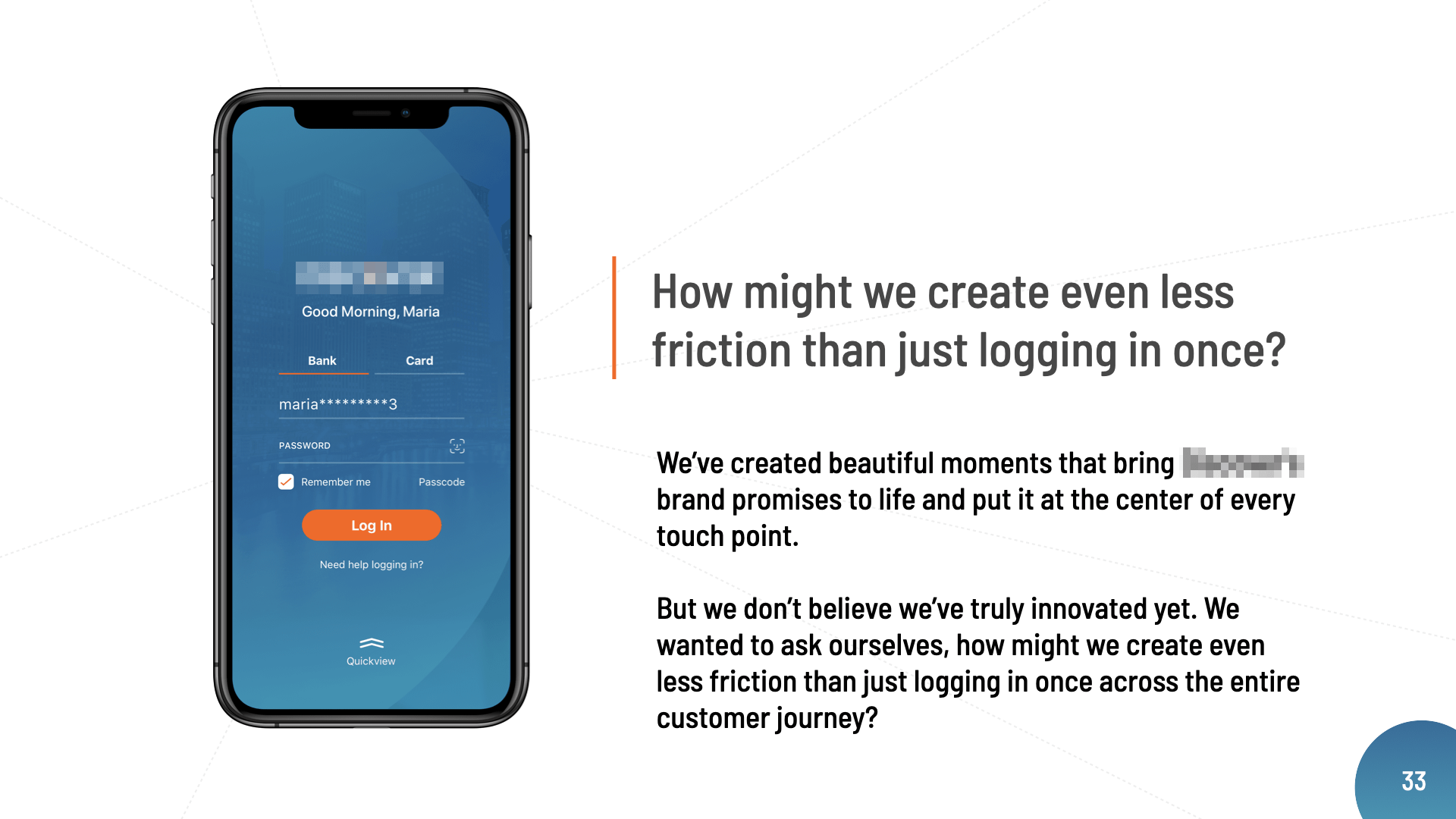

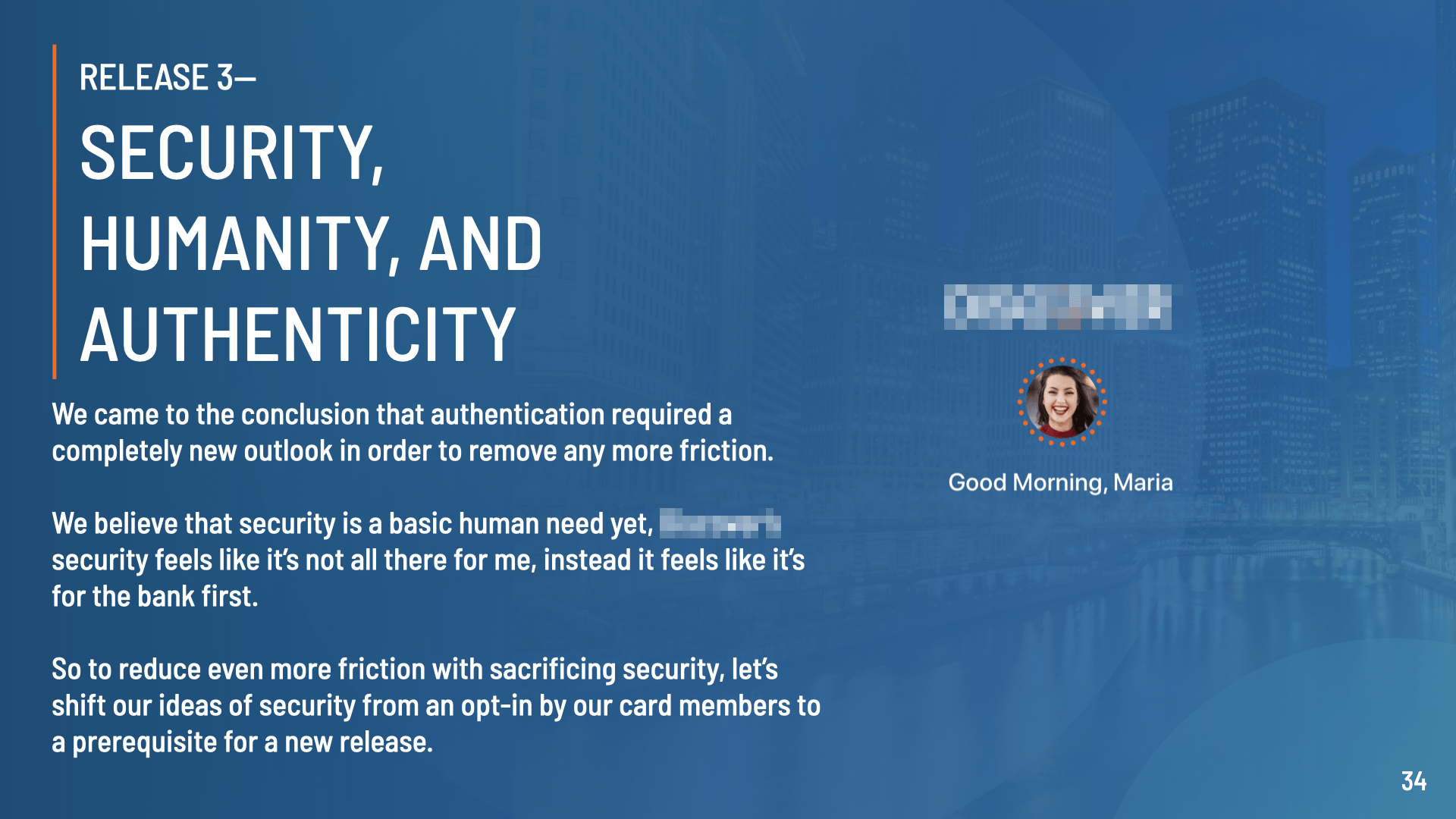

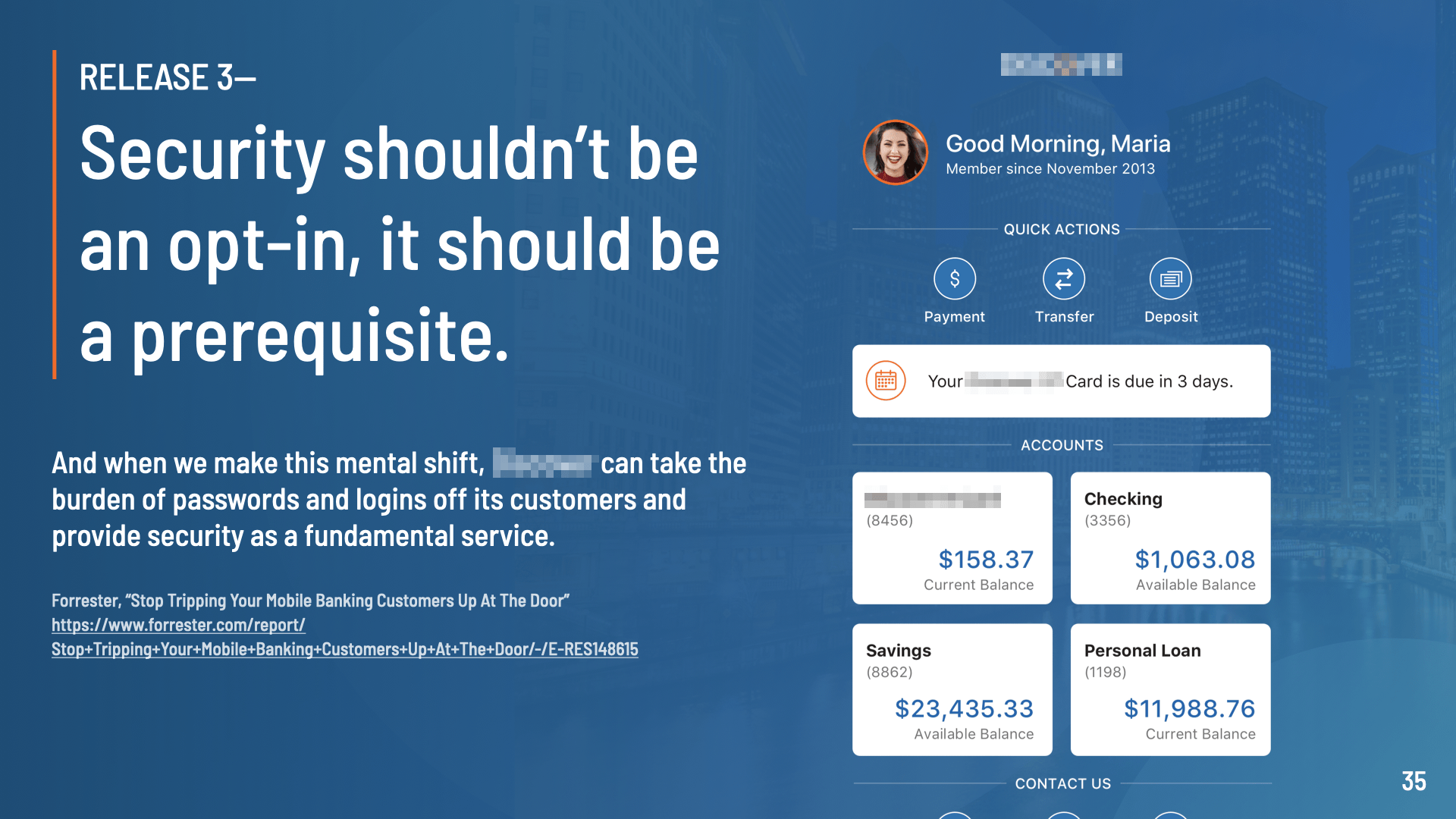

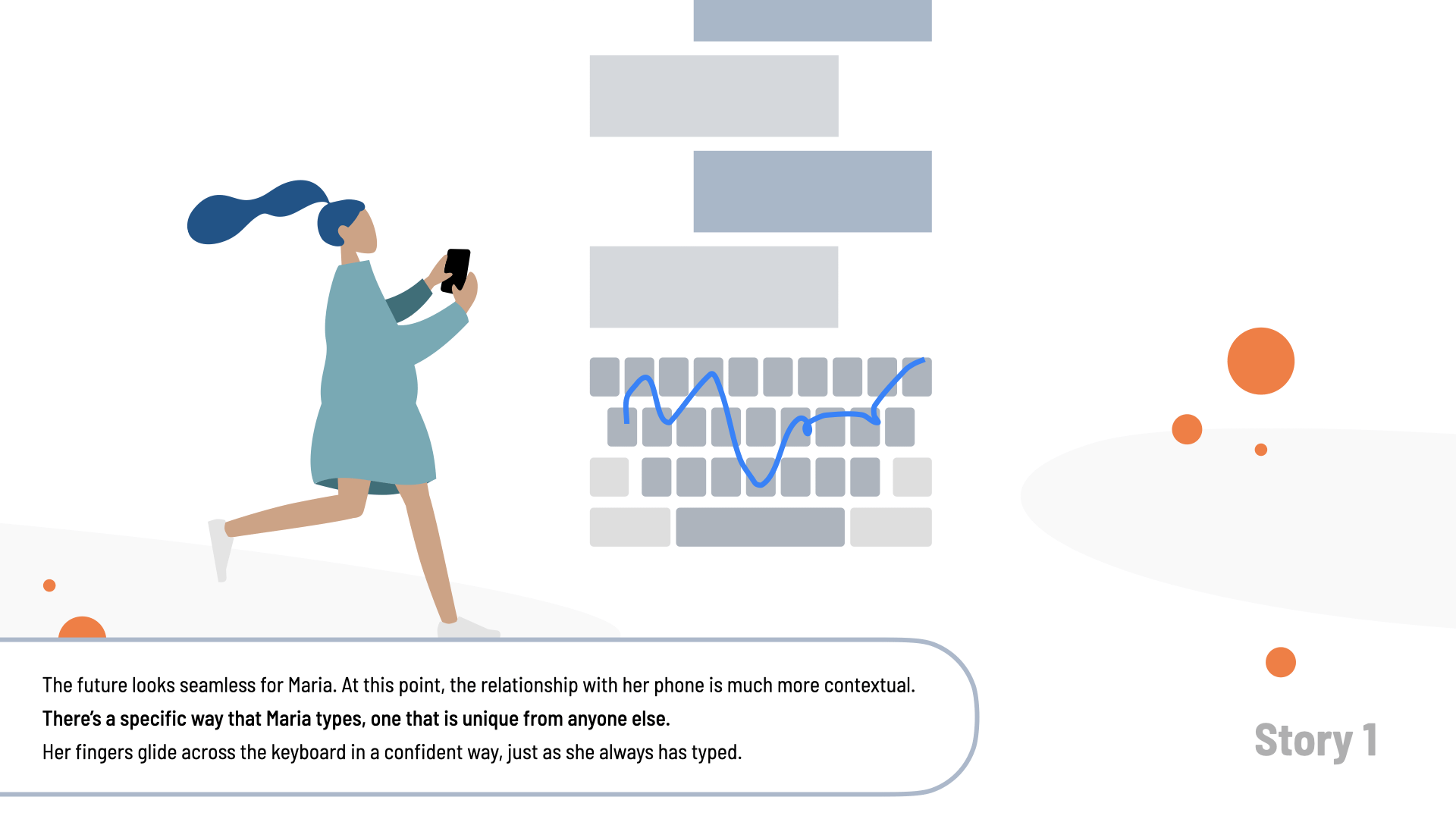

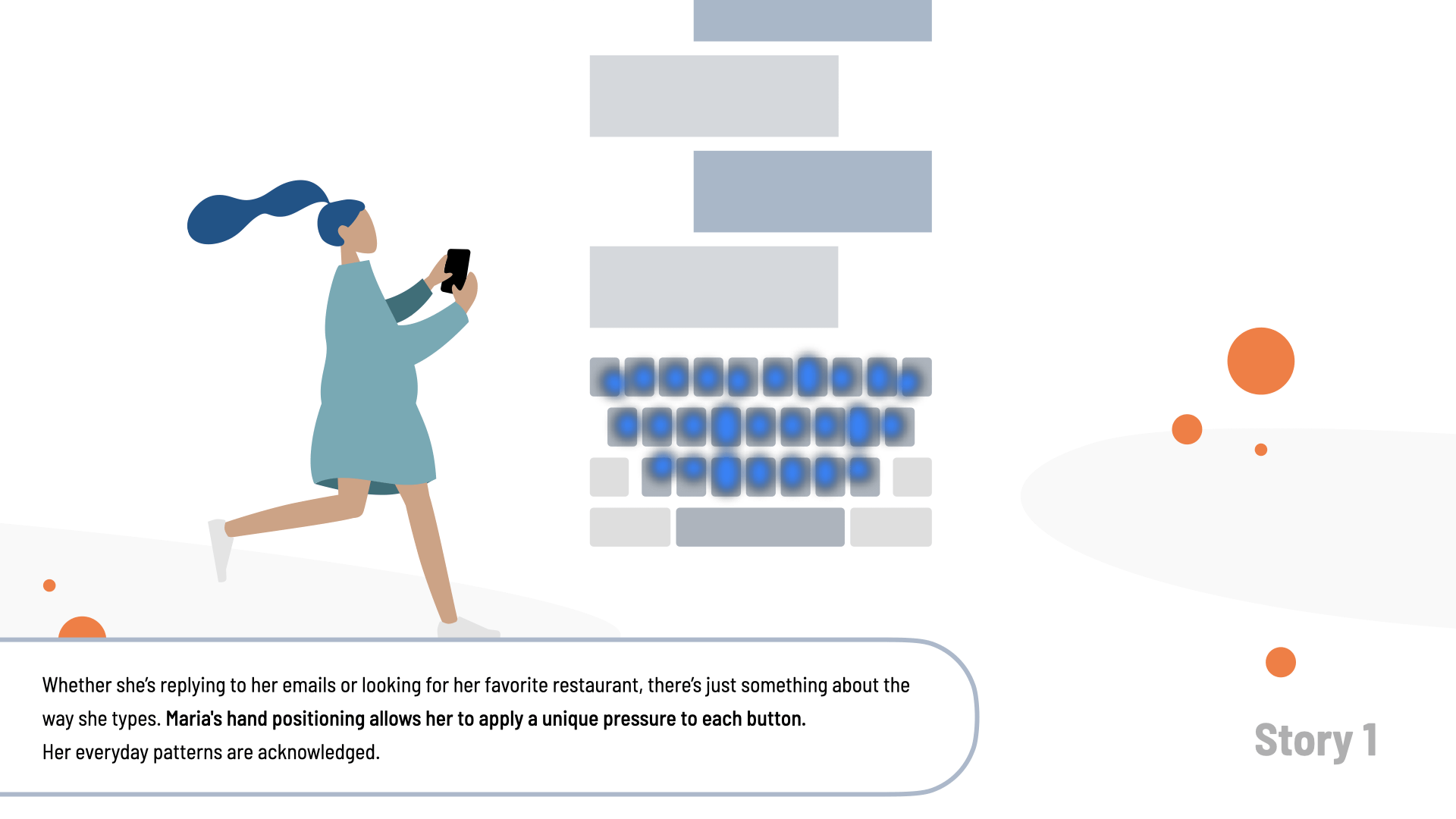

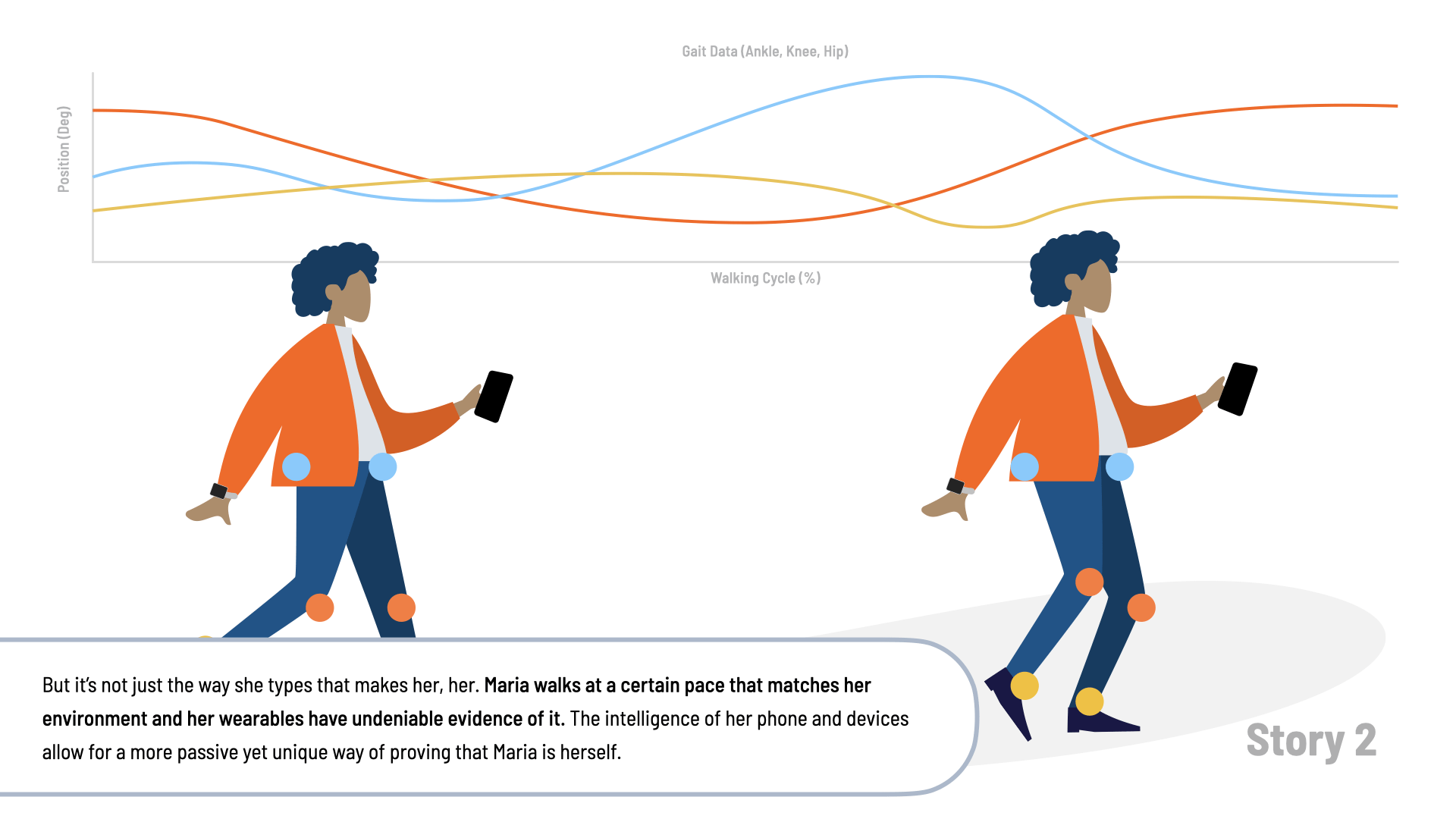

We developed a progressive authentication framework that not only heightened security but was also intuitive for users. We explored multiple forms of authentication, including biometrics, push authentication, and location-based factors. This tackled the prevalent issue of password fatigue and the associated risk of security breaches.

Interoperable Authentication Roadmap

A five-year strategic roadmap was created to phase in interoperable authentication methods across all our client's portfolio services, accommodating future technology shifts and customer behavior changes.

Outcome

The solution set a new benchmark for secure, customer-friendly authentication practices. It not only addressed the immediate risk associated with weak password practices but also positioned out client as a forward-thinking leader in financial service security.